This article is the second in a series written specifically as guidance for project managers.

Many projects suffer from the late involvement, or absence, of the procurement professional. It is the Project Manager’s responsibility to determine the requirement (or not) for specialist procurement skills. The series sets out to educate project managers in the essential considerations, and to inform the PM’s decision as to the need for specialist procurement resource.

The first article (Part 1) answered the question, “When and why do project managers need supply planning?” This article covers three key elements of supply planning – requirements analysis, supply market analysis, and risk management – and six tools and techniques used in the supply planning process. The article concludes with a brief comment on the scope of supply planning and the next steps.

Just as project planning is a dynamic process, with the plan being revisited and refined, so too is supply planning. Interaction with the supply market is an iterative process. Several iterations may be necessary to ensure that the supply market exists, is ready to supply and is accessed in a way or ways that that achieves the best commercial outcome. The plan covers what and how goods and services will be purchased, which suppliers will be targeted, and the way that goods and services are to be bundled and contracted. The iterations may modify the requirement, the supply market and the plan.

Purchase Requirements Analysis

The first step in supply planning is to compile a list (the ‘portfolio’) of products and services that are to be procured. This can start before the final requirements are known, and can include different options for meeting the same functional requirements.

Depending on the scope of the project, in addition to the products and services required during the product, there may be requirements to procure ongoing maintenance. Such requirements may have significant impact on the engagement with the supply market, so also need to be considered.

The portfolio of requirements can be analysed using a technique known as ‘supply positioning’.

Procurement Tools & Techniques #1 – Supply Positioning

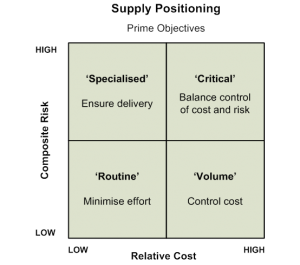

Supply positioning is a portfolio analysis technique for discriminating between, and developing specific procurement strategies for, different supplies. Conceived by Elliot-Shirecore and Steele (1985), the supply positioning model was concerned with profit potential and business exposure to supply risks within a general purchasing context. In a project context it is more appropriate to consider cost and risk to the project.

The position of items to be purchased are plotted on a 2-dimensional matrix with axes representing cost and risk (Figure 1).

The axes can be defined to suit the aims and value of supplies within the project-specific context. Project managers may find it helpful to consider implications for the overall project (the risk to quality, timing, resource requirements and overall project cost) rather than simply the risks related to the item specification and supply. Figure 1 uses composite risk to the project vs. the direct cost of the goods/services.

Positioning supplies on the matrix helps to determine appropriate procurement strategies. Generic strategies (which will not be covered here) have been developed for each quadrant of the matrix. Figure 1 shows, for each quadrant, the prime objectives of these strategies.

In developing specific strategies, it is necessary to take into account suppliers’ perceptions of the opportunities arising from the project. Spend on an item does not necessarily reflect suppliers’ interest; this obviously depends on how large the supplier is, and on other factors. Aggregation or bundling (and in some instances separation/unbundling) of supplies into supply packages will determine the position on the matrix and influence the attractiveness to suppliers. By engineering supply opportunities that are more attractive, we can lower both cost and risk to the project. And, while it may be useful to think of suppliers in terms of risk to the project, we might also ask, ‘Can this supplier contribute to a real improvement in the way the project is delivered?’

Before considering individual suppliers it is helpful first to examine the structure and characteristics of the supply market.

Supply Market Analysis

The purpose of supply market analysis is to establish the status of the supply market relevant to the areas of procurement and the likely impact the procurement will have on the market.

The extent of supply market research and analysis depends on the scale and complexity of the project and its procurement requirements. For a large scale, long-term project it may be appropriate to develop detailed strategies for many goods and services from all quadrants of the supply positioning matrix. For smaller projects we may be concerned with just a few items within the ‘critical’ and ‘specialised’ quadrants. Even with very small projects, some research may be helpful in developing the best approach to securing supplies under the most favourable terms in difficult supply circumstances.

Supply market analysis is conducted to ascertain:

- the number of suppliers and their respective market shares (market structure)

- the nature of competition between suppliers

- the value of the project/business as a potential customer (supplier preferencing)

- the nature and quality of the supply chain ( and project vulnerability)

- substitute or alternative goods or services

- sustainability impacts within the supply market

Depending on the outcome of the general market analysis, further evaluation may be warranted, for example by

- conducting market soundings

- exploring opportunities for developing suppliers and markets.

The first step in analysing the market structure is to define the relevant market or market segments under consideration. This will help to focus the supply market analysis and target the relevant suppliers. The nature of competition, in particular the existence of monopolies or oligopolies, will influence choices in procurement approach.

Procurement Tools & Techniques #2 – Supply Market Concentration

The existence of oligopolies may be inferred by measures of market concentration, for example Concentration Ratio. Closer examination of the market characteristics – whether it is purely a product or service or a combination, and whether the market is divided into commercial, technical and/or geographic segments – may reveal, on the one hand, there is monopolistic competition in some segments or, on the other hand, that alternative product and service combinations are more open to competition.

Procurement Tools & Techniques #3 – Porter’s 5 Forces

Porter’s 5 Forces Analysis (or, preferably, 6 Forces Analysis) may be used to gain an understanding of the nature of competition in the supply market. Suppliers’ competitive strategies will influence the way we can engage interest. The relative power of buyers and suppliers will influence our approach. Barriers to entry, the treat of substitutes and the existence of complementary products, may afford opportunities either to influence existing suppliers, source substitutes or encourage new entrants.

Procurement Tools & Techniques #4 – Supplier Preferencing

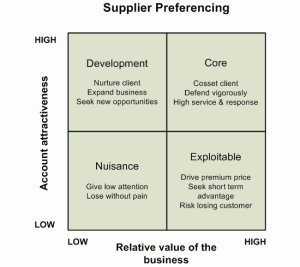

Supplier Preferencing is a technique used to assess the interest that a supplier may have in an account (in this context, a procurement opportunity). The supplier preferencing matrix (Figure 2) plots account attractiveness to the supplier against relative value (e.g. the value of the contract as a percentage of supplier’s total revenue).

Supplier preferencing enables us to build a picture of a supply market by understanding our relative importance to suppliers and their likely response to the procurement opportunity. Generic account strategies may be inferred for each quadrant of the matrix. Figure 2 shows, for each quadrant, the prime objectives of the strategies. The inferred strategies can be tested and modified according to past experience and intelligence gained through interactions with the supplier.

Positioning potential suppliers on the matrix helps us to target those suppliers with the best fit, and to determine appropriate supplier conditioning and procurement strategies.

Supplier preferencing is a relatively simple analysis which is satisfactory for imminent transactions or projects of relatively short duration. Looking further out, as may be necessary for long projects, a model which takes account of the dynamics of the supplier’s circumstances may be more suitable. The article ” How to Select Strategic Suppliers – Part 1: Beware the Supplier’s Perspective ” offers guidance on gaining insight to the future development and sustainability of supply, which may be relevant to large-scale, long-term projects.

Procurement Tools & Techniques #5 – Supply Market Soundings

Market soundings may be used to determine the capability and capacity of markets in relation to specific projects, or where a project may impact on the way in which the market will operate. Market sounding will also provide the opportunity to ‘market’ the project and its outcome to the supply side.

Market soundings may be taken in relation to:

- industry impact assessment

- technical or business feasibility

- project sizing, requirements specification and supplier engagement

- aggregation and bundling

- innovative solutions, alternative products or service models.

Procurement Risk Assessment

Experienced project managers will be familiar with risk management. Managing risk in procurement and supply uses well established general techniques, so the intention here is to give a procurement perspective rather than present anything fundamentally different.

Having applied supply positioning and supplier preferencing models, users will have come to some conclusions as to which supplies represent a risk and potentially the greatest impact.

Risk management priorities within projects are usually determined by composite risk and immediacy of the threat. When dealing with procurement and supply, disruptions of some sort are almost inevitable; so vulnerability of supply chains and the likely duration of any disruptions are particular factors that need to be considered.

Procurement Tools & Techniques #6 – Vulnerability analysis

The purpose of vulnerability analysis is to examine the supply chains in more detail to understand specific vulnerabilities and develop plans to mitigate risk. This activity can often lead to creative alternative approaches to meeting the functional requirements.

Vulnerability assessment can be taken to extreme lengths, so the first thing to stress is pragmatism. The breadth and depth of the assessment really needs to be set according to the scale and duration of the project.

Typically we will be looking at potential failure, loss of control over, or constraints within, the supply chain:

- supply-demand balance

- raw materials availability

- raw materials cost trends

- product lifecycle

- security of the suppliers

- supply chain operation

- macro-environment (political, economic social technical, legislative, environmental factors

The Next Steps

In light of the Requirements Analysis, the Supply Market Analysis and the Risk Assessment, the next step is for the project team to establish a set of procurement objectives for significant purchases. This will be followed by the development and evaluation of strategy options.

Significant purchases would, in order of priority, be those within the critical, specialised and volume quadrants of the supply positioning matrix.

When planning the market research For smaller projects we may be concerned with just a few items within the ‘critical’ and ‘specialised’ quadrants. By selectively applying the tools and techniques outlined in this article, we can progressively filter the areas of focus to those requirements for which there are signs that the supply market is limited or is difficult to access, for example where suppliers lack interest or have substantial power over the buyer.

A useful starting point for the development of strategy options is to reconcile supplier and purchaser’s perspectives. Generic strategies have been developed for each permutation of supply positioning and supplier preferencing quadrants. The article ” How to Select Strategic Suppliers – Part 2: Reconciling Buyer and Supplier Perspectives” provides an outline of the technique.

If you need any help, please get in touch. For contact details: click here.

Related Articles:

- Procurement for Projects: Supply Planning (Part 1)

- Procurement for Projects? …or Business as Usual?

- Three Principles for Effective Services Contracting

- How to select suppliers to create value (Introduction)

- How to select suppliers to create value: Supplier Appraisal

- How to Select Strategic Suppliers – Part 1: Beware the Supplier’s Perspective

- How to Select Strategic Suppliers – Part 2: Reconciling Buyer and Supplier Perspectives

This is going to be very useful for me thank you very much for posting