A recent article in Procurement Leaders magazine, “Are e-auctions all they are cracked up to be?”, concludes “by taking the personal touch out of the bidding process, you’re losing the opportunity to leverage your face-to-face skills to get really [to] know a potential supplier.” The article seems to be founded on the premise that e-auctions (reverse auctions) might typically be run in circumstances where buyer-supplier relationships are important.

I have been a long-standing critic of indiscriminate use of procurement e-auctions. Reverse auctions do have an important place in the procurement toolkit but are often misused. So, what constitutes misuse? What can go wrong? And when is it appropriate to use reverse auctions?

When reverse auctions are misused

Responsible use of reverse auctions needs to take account of the potential commercial leverage and the psychological impact on suppliers. Tendering and competitive bidding may not deliver the best deals, neither necessarily do reverse auctions.

Not only can it be ineffective, it can also be damaging to invite a ‘partnership’ supplier to a reverse auction for their core products/services. It sends mixed messages to the supplier – undermining the trust that is essential for effective partnership – and is definitely not the way to get the best long-term deal.

Reverse auctions are unsuitable for complicated user-specified requirements, with long future continuity of supply. Other risky uses include benchmarking without intent to contract, and crude approaches to beating down the incumbent.

What can go wrong with reverse auctions?

The risks to successful outcomes increase when involving suppliers who are not really interested, either because they believe the business is unavailable, or they cannot make commercial sense of it.

If suppliers attend a reverse auction where margins already don’t add up, it makes sense for them not to bid at all if the bidding falls below their minimum price. Alternatively they may decide to be disruptive. Reverse auctions are a great place for suppliers to have some fun if they are prepared to walk away!

I know of a case where no acceptable suppliers bid. The customer had to renegotiate from a weak position and the price increased substantially. Probably a negotiation without auction could have secured a small reduction or at worst a continuation of the existing price.

In another case a bid was accepted and business started without a formal contract. Within a month the customer was subjected to a 10% price increase. A settlement was reached rather than go to reverse auction again.

Supplier strategies to disrupt reverse auctions

Here are 4 strategies that may appear as 2nd/3rd/4th generation reverse auctions erode suppliers’ margins: –

- Invited supplier does not bid at all.

- Supplier who does not want the business pushes the price down to unsustainable levels only to withdraw, leaving the competition with loss-making business.

- Supplier bids to unsustainable level to win the bid, then will not commit to contract term, fails to supply and/or renegotiates the price upwards.

- Supplier bids to unsustainable level to win the bid, then will not commit to the product specification, claims ambiguity around the specification, or negotiates add-ons.

It makes sense, therefore, to use a reverse auction only when conditions are favourable.

When is it appropriate to use reverse auctions?

Conventional use of Purchasing Portfolio Analysis or Supply Positioning might suggest categories in the routine/non-critical and volume/leverage segments. It would be inappropriate to assume that items in these segments are, automatically, candidates for reverse auction. There is often potential for partnerships of some form in these segments, notably partnerships to improve purchasing efficiency of ‘non-critical’ items and value engineering for ‘leverage’ items.

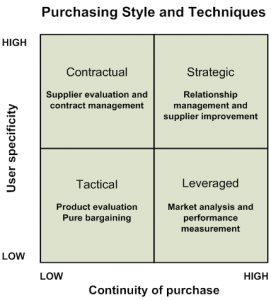

A more appropriate analysis is shown in Figure 1 where we would be looking primarily at ‘tactical’ items – relatively uncomplicated user-specified requirements, without long future continuity of supply.

Even so, reverse auctions are best reserved for positions where (a) market concentration is low and there are a good number of suppliers who are interested, and (b) customer-supplier power is balanced or moderately in favour of the customer.

Clearly, reverse auctions will be ineffective for monopoly supply, and will be relatively high risk when dealing with oligopolies. When supply market concentration is high, and the customer is dominant over individual suppliers, a negotiation is more likely to be effective than relying on a competition between a few parties.

Related Articles:

I’d be interested in understanding the use of eAuctions when it comes to hourly rates for Consulting Firms. We’ve received “best and final” rates from our premier consulting firms, but are now also looking at using an eAuction as the final negotiation.

Thoughts?

Negotiation and auction are alternative approaches, so I can’t see how e-auction can be the “final negotiation”.

I feel strongly that e-auctions are not appropriate for most consultancy. The benefits from consultancy are realized in delivered outcomes, not in hourly standard activities to be performed. If you were to analyse the consultancy services using Supply Positioning (see http://acuityconsultants.com/wp/2012/03/procurement-for-projects-supply-planning-part-2-3-key-elements-6-tools-techniques/ ) you might conclude that the services are Specialized. I suggest you differentiate between consultants and select the one that offers best value for money.

I’ve written several article on how to select suppliers to create value (just follow the above link). Also you may be interested in advice to the Cabinet Office on reforming the sourcing of consultants and interim managers: Consultancy and Interim Assignments, “…if you could tell me how to value the outputs that would be fantastic.” http://www.acuityconsultants.com/news.html#blog8

We have rate cards with all our preferred consultancies and many of these consultancies have similar specialities. If we have a piece of work and the consultancies submit a propsal for how they will deliver the work, why wouldn’t an eAuction help negotiate rates? They can submit their rate card if they like but if they have spare resource, they may be prepared to discount slightly so as to win the business and so their consultants are bringing in fees. As long as you have the proposal and the services agreed upfront, I fail to see why an eAuction is inappropriate.

For reverse auction to be effective you need the 4 C’s: Competition; Clarity (of specification); Capacity (in the marketplace) and Commonality.

If you have a specified piece of consultancy work and you cannot differentiate between potential suppliers then e-auction is a valid approach. I wouldn’t normally recommend e-auctions, framework agreements or rate cards for consultancy because generally the suitability, efficiency and effectiveness of suppliers’ resources will vary from project to project. But I wouldn’t rule out use of e-actions entirely. The effort and cost involved in running RfX for each project may favour use of framework agreements or rate cards. In these cases, e-auctions may be suitable.

I am about to encounter a reverse audit as a supplier for a majhor company and need help understanding what i am getting into..any chance i can get advise? do you do anyconsulting? Please call me 914-741-2706 cell 914-907-9578

thanks

Lisa

Really interesting article, wish I had seen it sooner! Referring to your comments, we have seen Management Consulting rate cards being eAuctioned through our tool a number of times by a leading global insurance firm to great success. You can auction off the blended rates of various levels of consultant to help mimic your actual call-off pattern. We’ve done the same for a legal framework for Aggreko, which they wrote about here: http://blog.marketdojo.com/2017/01/simplify-enhance-and-economise-legal.html